Vietnam’s economy grows at 5.7 percent, WB forecasts

According to its East Asia and Pacific Economic Update 2012, the WB says after a prolonged period of heightened turbulence, Vietnam’s economy is gradually entering a more stable macroeconomic environment, especially after the government introduced Resolution 11 in February 2011 to stabilize the economy and to ensure social stability.

While

Vietnam’s economy has started to stabilize,

the significant tightening of macroeconomic policies,

along with uncertain global economic environment, are beginning to

take a toll on its economic growth, the report says.

While

Vietnam’s economy has started to stabilize,

the significant tightening of macroeconomic policies,

along with uncertain global economic environment, are beginning to

take a toll on its economic growth, the report says.

Real GDP growth decelerated from 6.8 percent in 2010 to 5.9 percent in 2011 and further to 4.0 percent in the first quarter of 2012 as domestic demand slowed, affecting construction, services, and utilities.

Thanks to a combination of these measures and falling food prices, it says, inflation declined to 10.5 percent year-on-year in April 2012 from a peak of 23 percent in August 2011.

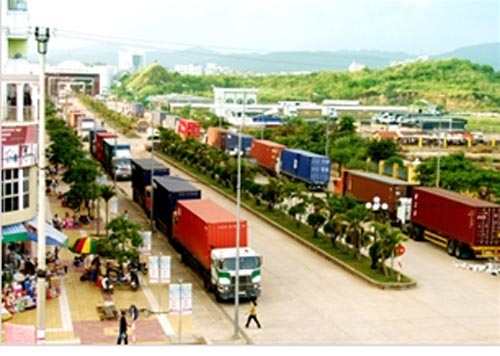

In the meantime, export earnings in the first quarter of 2012 increased by 23.6 percent with key labor intensive manufacturing exports such as garments, footwear, and furniture growing by 14-18 percent.

Pressures on the exchange rate have continued to decline in the first quarter of 2012, as confidence in the domestic currency has gradually picked up. The unofficial exchange rate has remained close to the lower edge of the plus/minus 1 percent band around the official rate since the 8.5 percent devaluation of the VND against the US dollar in February 2011.

The increased supply of US dollars in the market has enabled the State Bank of Vietnam (SBV) to replenish foreign exchange reserves in the first months of 2012, which are reportedly at nearly 7.5 weeks of imports.

Regarding the credit market, it says the government measures have led to a sharp decline in credit growth, from 32.4 percent at the end of 2010 to 14.3 percent by the end of last year. However, asset quality has deteriorated in part due to rapid credit growth before 2011 and the slowdown in the real estate sector. Official non-performing loans have increased from 2.2 percent of assets at the end of 2010 to 3.6 percent in March 2012, but are likely to be higher if measured by international accepted standards.

Monetary tightening has also added liquidity stress in some smaller banks. In response to this, the authorities have provided liquidity and other support to ailing banks.

In a move to shore up the economy, SBV reduced policy interest rates by 200 basic points in March and April (from 15 to 13 percent) and announced further reductions of at least 100 basis points every quarter during 2012.

According to the WB, Vietnam’s public debt is likely to remain sustainable if the economic recovery continues and the authorities remain on the current path of fiscal consolidation. The WB’s Low-Income Country Debt Sustainability Analysis shows that the Southeast Asian nation remains at a low risk of debt distress and the largest source of uncertainty to debt sustainability comes from implicit obligations to state-owned enterprises (SOEs), which are not captured under government and government-guaranteed debt statistics.

A reliable estimate of such liabilities is not available, which limits the government’s ability to manage associated risks.

The authorities are stepping up efforts to collect reliable and up-to-date information on contingent liabilities (mostly in the SOEs and State economic sector) and to monitor and manage potential fiscal risks.

The WB supposed that in the short run, Vietnam should maintain macroeconomic stability and restore investors’ confidence, while addressing longer-term structural reforms.

Even if only a subset of the announced structural reforms is implemented steadfastly, Vietnam should return to a more sustainable macroeconomic environment while laying the foundations for greater efficiency and productivity to drive medium- and longer-term growth, it says.

(VOV)