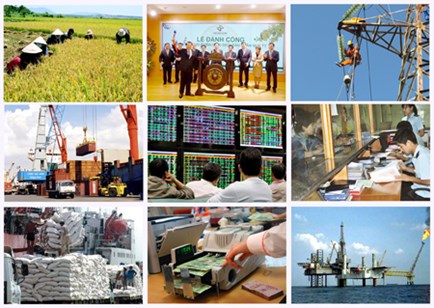

Vietnam economy: Opportunities and Challenges

A brighter outlook is forecast for the Vietnamese economy in 2015 and the following years amid difficulties and challenges, according to economic expert Nguyen Minh Phong.

Opportunities and prospects

Generally, in 2015 and in the medium term, Vietnam will maintain macroeconomic stability with GDP growth and inflation standing at around 6-6.5%.

According to most estimates, the country’s GDP will increase by at least 10% over the period 2015-2025 on the heels of a large number of free trade agreements (FTAs) to come into effect over the next year.

The business environment will be greatly improved as a result of efforts to realize FTA commitments that Vietnam gets involved in and restrict international trade disputes through new experience and adaptation capacity.

The national economy will have stronger liberalization and internationalization with a higher level of competitive pressure and equal economic cooperation. The inflows of foreign investment into Vietnam and the nation’s overseas investment inflows will increase more rapidly and sizably with diverse structure in various realms and investors.

Meanwhile, overseas remittances are expected to see sharp increases.

Economic structure will undergo a drastic shift towards developing the support industries and partaking in international supply chains along with FTA member states.

The tourism, agriculture and seafood sectors will continue to grow smoothly. The competitiveness of key export items like garments and textiles, footwear and rice will improve on the back of reduced tariff barriers and production costs, and cheaper raw materials.

Businesses will also have more opportunities to participate in public procurement while State-owned enterprises (SoEs) restructuring and commercial banking operations will be boosted. This year will see stronger merger/acquisition (M&A) activities, notably in the fields of real estate, production and sales of consumer goods, banking, garments and textiles and mechanical engineering.

The financial market will continue to witness the mounting inflow of foreign capital and the growth of open funds. Credit growth will grow at a faster rate with more flexible credit conditions, adding impetus to supporting economic growth. Bad debts will be controlled step by step to ensure system stability and approach common international standards.

The consumer goods market will see improvements with better quality goods at cheaper prices. Hi-tech products are to be diversified with lower prices owing to the rapid development of science and technology.

The labour export market will continue to grow strongly, thus improving job creation and ensuring social welfare for different localities.

The real estate market will gradually form a new and more efficient growth cycle in terms of scale, speed and balance with a focus on social housing segment, apartments and business premises at reasonable prices, in a favorable position and with uniform infrastructure and adequate social services that are consumed in different forms- for lease, lease-purchase and purchase-lease and managed by trust companies having professional responsibility.

Challenges

Businesses will face increased competitive pressure and the openness of the service sector, notably financial services along with risks and higher costs for technical barriers and higher demand for financial capability and internal administration mechanisms. Bad debt and large inventories of less competitive and environmentally unfriendly products lacking technological innovation remain the burden on less dynamic businesses.

Stricter rules of origin and intellectual property right protection will be a major challenge for businesses overly dependent on outward materials, thus leading to increased costs, reduced opportunities for improving income and backward manufacturing processes of many domestic production industries. Regulations on environmental protection and labour will increase production costs of enterprises.

Difficult businesses are mostly related to real estate business, mechanical engineering, small and medium enterprises (SMEs) with outdated technology and enterprises fall behind in renovating equipment, technology and management capability.

The livestock sector will continue to face competitive pressure of discounts from imported products and increasing input costs as well as technical barriers without technological innovation for farming models.

FDI projects, particularly in garments and textiles, may narrow the benefits local firms get from the FTAs. Consequently, it is essential to pay greater attention to high-tech projects with strong financial capacity and effective environmental protection measures.

The automobile industry will have to reduce market segments unable to encounter direct competition with cars imported from the US and Japan- advanced automobile manufacturers.

The banking sector will be still facing pressure on bad debt and needs to improve administration capacity and standardization of operations under general international standard and integration commitments.

VOV

Six-house cooperation supports farmers to increase the value of agricultural products

Six-house cooperation supports farmers to increase the value of agricultural products

Ips achieve key targets ahead of schedule

Ips achieve key targets ahead of schedule

Enterprises promote cooperation in green transformation

Enterprises promote cooperation in green transformation

Digital technology applications to create breakthroughs in production and business

Digital technology applications to create breakthroughs in production and business

People, enterprises as subjects, goals...

People, enterprises as subjects, goals...

Management elevated to tackle tax revenue loss

Management elevated to tackle tax revenue loss

Some new points of Decree 128/2024/ND-CP amending and supplementing trade promotion activities

Some new points of Decree 128/2024/ND-CP amending and supplementing trade promotion activities

Solving challenges, promoting auxiliary industries

Solving challenges, promoting auxiliary industries

OCOP – the process of brand and value affirmation

OCOP – the process of brand and value affirmation

Binh Duong strengthens international cooperation, heightens industrial status

Binh Duong strengthens international cooperation, heightens industrial status